Descript AI Video Editing: 7 Revolutionary Features Transforming Content Creation in 2025

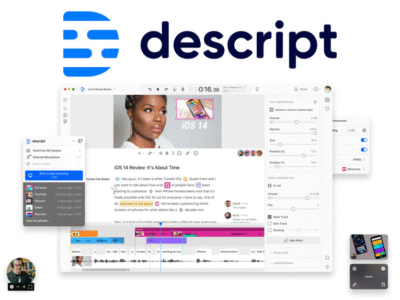

<span class="citation-101 citation-end-101">Descript is revolutionising how content creators approach video and podcast production, making professional-quality editing as simple as editing a text document.</span> <span class="citation-100 citation-end-100">This new AI-powered platform has emerged as a game-changer in 2025, offering creators an intuitive alternative to traditional video editing software with its unique text-based editing approach. </span> <h2>What is Descript?</h2> <img class="size-medium wp-image-5416 aligncenter" src="https://aitoolshive.com/wp-content/uploads/2023/07/image-300x225.png" alt="Screenshot of the Descript AI video and audio editing interface showcasing multi-track editing, transcription, and device input options " width="300" height="225" /> Descript represents a paradigm shift in content creation technology. <span class="citation-99 citation-end-99">Unlike conventional editing software that requires technical expertise, this tool allows users to edit videos by simply editing the automatically generated transcript.</span> <span class="citation-98 citation-end-98">When you delete text from the transcript, the corresponding video segment is automatically removed, making the editing process incredibly intuitive.</span> <span class="citation-97 citation-end-97">The platform combines artificial intelligence with a user-friendly design to offer features like automatic transcription with up to 95% accuracy, AI-powered voice cloning through its Overdub feature, and advanced audio enhancement tools.</span> <b><span class="citation-96">Descript AI video editing</span></b><span class="citation-96 citation-end-96"> has gained traction among podcasters, YouTubers, marketers, and educators who need to produce professional content quickly without extensive technical knowledge.</span> <h2>Key Features of the Descript Platform</h2> <h4>The Text-Based Video Editing Revolution</h4> <img class=" wp-image-5418 aligncenter" src="https://aitoolshive.com/wp-content/uploads/2023/07/envato-labs-ai-33b0502d-59d9-4982-85e6-5505a972b963-1-300x171.webp" alt="A user editing a video in Descript by deleting a sentence from the transcript, showcasing the platform's text-based editing feature." width="360" height="205" /> <span class="citation-95 citation-end-95">The cornerstone of Descript is its revolutionary text-based editing system.</span> <span class="citation-94 citation-end-94">Users can upload their video content and receive an instant transcript that's synchronised with the media.</span> <span class="citation-93 citation-end-93">This transcription process typically takes just 3-5 minutes for a 30-minute video, achieving approximately 95% accuracy.</span> <span class="citation-92 citation-end-92">The magic happens when you edit the text – any changes made to the transcript automatically apply to the video, making complex editing tasks as simple as using a word processor.</span> <h4>AI-Powered Underlord Assistant</h4> <img class=" wp-image-5420 aligncenter" src="https://aitoolshive.com/wp-content/uploads/2023/07/envato-labs-ai-e150479c-0b56-40f4-831e-ad053da912c2-1-300x164.webp" alt="An illustration of an AI assistant automating video editing tasks, representing Descript's powerful Underlord feature." width="348" height="190" /> <span class="citation-91 citation-end-91">Descript introduces Underlord, an intelligent AI assistant that handles tedious editing tasks.</span> <span class="citation-90 citation-end-90">This powerful feature can automatically remove filler words, generate episode titles and show notes, create clips for social media, and even translate content into over 20 languages.</span> <span class="citation-89 citation-end-89">Users can simply type commands like "Please repurpose this video into a 15-second TikTok video using the most engaging parts", and Underlord executes the task.</span> <h4>Advanced Audio Enhancement Tools</h4> <span class="citation-88 citation-end-88">The platform includes Studio Sound technology that dramatically improves audio quality by removing background noise and enhancing voice clarity.</span> <span class="citation-87 citation-end-87">This AI-powered feature can transform recordings made with basic microphones into professional-sounding audio.</span> <span class="citation-86 citation-end-86">Additionally, Descript offers automated silence detection and removal, helping creators maintain engaging pacing in their content.</span> <h4>Voice Cloning and Overdub Technology</h4> <span class="citation-85 citation-end-85">One of the most impressive aspects of the software is its Overdub feature, which can clone your voice and generate new audio from text.</span> <span class="citation-84 citation-end-84">This technology allows creators to fix mistakes or add new content without re-recording entire segments.</span> <span class="citation-83 citation-end-83">The voice cloning requires only a short sample of your voice to create realistic artificial speech that maintains the original tone and inflexion.</span> <h2>Descript's Pricing Tiers: A Comprehensive Analysis</h2> <span class="citation-82 citation-end-82">Descript offers flexible pricing tiers to accommodate different user needs and budgets.</span> <span class="citation-81 citation-end-81">The platform provides four main subscription options, each designed for specific user categories:</span> <div class="source-inline-chip-container ng-star-inserted"></div> <ol> <li><b><span class="citation-80">Free Plan Benefits and Limitations:</span></b><span class="citation-80 citation-end-80"> The Free plan offers 60 media minutes per month and 100 lifetime AI credits, allowing users to explore the platform's capabilities.</span> <span class="citation-79 citation-end-79">However, exports are limited to 720p with watermarks, and cloud storage is restricted to 5GB.</span> This tier includes access to Underlord and basic AI features, making it suitable for testing the platform. <div class="source-inline-chip-container ng-star-inserted"></div></li> <li><b>Paid Subscription Options:</b> The Hobbyist plan starts at $16 monthly (or $12 annually), providing 10 hours of transcription, 1080p watermark-free exports, and 100GB storage. The Creator plan at $24 monthly offers 30 hours of transcription, 4K exports, and 1TB storage with unlimited advanced AI features. <span class="citation-78 citation-end-78">The Business plan at $50 monthly includes 40 hours of transcription, 2TB storage, and team collaboration features.</span> <div class="source-inline-chip-container ng-star-inserted"></div></li> </ol> <h2>Real-World Applications and Use Cases</h2> <h4>Podcast Production Workflows</h4> <p style="text-align: center"><img class="alignnone wp-image-5422" src="https://aitoolshive.com/wp-content/uploads/2023/07/envato-labs-ai-6fbec4ba-deff-4014-95b5-9912af585df9-1-300x168.webp" alt="A podcast production setup featuring a microphone, headphones, and a laptop running Descript, highlighting its use for podcasters." width="371" height="208" /></p> <span class="citation-77 citation-end-77">Descript excels in podcast production, offering integrated recording capabilities through Descript Rooms.</span> Creators can record high-quality audio and 4K video locally, preventing internet connectivity issues from affecting recording quality. <span class="citation-76 citation-end-76">The platform automatically generates transcripts with speaker detection, allowing easy editing and repurposing of content.</span> To dive deeper, check out <code><a href="https://m.youtube.com/shorts/MuUHeonMiPY">our complete guide to starting a podcast</a></code>. <h4>Content Marketing and Social Media</h4> <span class="citation-75 citation-end-75">Marketing teams leverage Descript to repurpose long-form content into multiple formats.</span> <span class="citation-74 citation-end-74">The platform's AI can automatically identify the best moments in videos for social media clips, generate YouTube descriptions, and create audiograms for podcast promotion.</span> This capability significantly reduces the time required to maintain a consistent social media presence. You can <a href="https://www.youtube.com/watch?v=2orpwXDPNGA"><code>learn more about our content repurposing strategies</code></a> In our detailed article. <h4>Educational and Training Content</h4> <span class="citation-73 citation-end-73">Educational institutions and corporate training departments use Descript to create accessible, engaging content.</span> The automatic transcription feature ensures content accessibility compliance, while the text-based editing approach allows non-technical staff to create professional training materials. <h2>User Experience and Performance Reviews</h2> <h4>Positive User Feedback</h4> <span class="citation-72 citation-end-72">Users consistently praise the platform for its intuitive interface and time-saving capabilities.</span> Many report reducing video editing time by 40-70%, with particular appreciation for the filler word removal and silence detection features. Teams working on shared projects highly appreciate the collaborative features. <h4>Areas for Improvement</h4> Some users note that Descript requires stable internet connectivity and can be resource-intensive for large projects. <span class="citation-71 citation-end-71">Professional video editors sometimes find the advanced color grading and motion graphics capabilities limited compared to dedicated video editing software.</span> Additionally, the AI transcription occasionally struggles with heavy accents or specialized terminology. <h2>Comparison with Traditional Video Editing Software</h2> <p style="text-align: center"><img class="alignnone wp-image-5424" src="https://aitoolshive.com/wp-content/uploads/2023/07/envato-labs-ai-26a6af3e-e91c-48ea-ab18-f922c6547bb0-1-300x171.webp" alt="A comparison graphic showing the simplicity of Descript's text-based editing versus a complex traditional video editing timeline." width="342" height="195" /></p> Descript offers a fundamentally different approach compared to traditional timeline-based editors like <a class="ng-star-inserted" href="https://www.adobe.com/products/premiere.html" target="_blank" rel="noopener" data-hveid="0" data-ved="0CAAQ_4QMahgKEwjS7r-G6v-PAxUAAAAAHQAAAAAQuQE">Adobe Premiere Pro</a> or <a class="ng-star-inserted" href="https://www.apple.com/final-cut-pro/" target="_blank" rel="noopener" data-hveid="0" data-ved="0CAAQ_4QMahgKEwjS7r-G6v-PAxUAAAAAHQAAAAAQugE">Final Cut Pro</a>. While traditional software provides more advanced visual effects capabilities, Descript excels in speed and accessibility for creators focused on talking-head videos, interviews, and podcasts. The learning curve for this AI tool is significantly shorter than conventional editing software, with most users becoming productive within minutes rather than weeks. However, projects requiring complex visual effects may still benefit from traditional editing tools. <h2>Future Developments and AI Innovations</h2> Recent updates to Descript include enhanced video generation capabilities, allowing users to create custom animated clips from text prompts. <span class="citation-70 citation-end-70">The platform continues expanding its AI features with improved face detection, enhanced visual quality in video regeneration, and better multilingual support.</span> The integration of advanced AI models provides users with premium editing capabilities while maintaining the platform's signature ease of use. This tool is positioning itself as the future of accessible, AI-powered content creation. <h2>Getting Started with Descript</h2> New users can begin with <b>Descript AI video editing</b> by creating a free account on the <a class="ng-star-inserted" href="https://www.descript.com/" target="_blank" rel="noopener" data-hveid="0" data-ved="0CAAQ_4QMahgKEwjS7r-G6v-PAxUAAAAAHQAAAAAQvAE">official Descript website</a> (DoFollow Link) and uploading their first video or audio file. <span class="citation-69 citation-end-69">The platform automatically generates a transcript, allowing immediate editing through the text interface.</span> The comprehensive tutorial library and intuitive design ensure rapid onboarding for creators of all skill levels. <span class="citation-68 citation-end-68">Descript represents a revolutionary approach to content creation, combining artificial intelligence with user-friendly design to democratize video editing.</span> As the platform continues evolving, it's establishing itself as an essential tool for modern content creators seeking efficiency without sacrificing quality. If you need help getting started, <a href="https://aitoolshive.com/contact-us/">our team of AI experts can help</a>. While Descript is a powerful leader, it's part of a rapidly growing ecosystem of AI content tools;creators interested in exploring other options like <a href="https://aitoolshive.com/aitool/vizard-ai-2/">Vizard AI</a> can checkout our website <a href="https://aitoolshive.com/">AI Tools Hive</a>.